This section explains when, how, and how much to include in a nonbusiness use of or deduction for your home. It also explains how to figure the allowable business portion of a credit for your business use, for carryovers of such business uses to 2013. You can figure the cost of your taxable home under a business use. The table under Section D (above) shows each part of the cost under each of the three different bases, depending on whether you have a personal or corporate use of the home. If you are a nonresident alien employee, your cost of the home is included on Form 8829 and reported on Page I.

To figure the allowable expenses for business use of your home, you use the method used under the General Allowance Method (GAM). To figure the allowable carryover of a credit for business use to 2013, use the method described under the Carryover Method. General Allowance Method You should use the General Allowance Method for a home, even if you are a resident alien and if you have not included in the gross income any income from the sale of the home. This is true even if your home is rented.

You must reduce your basis in the home by its fair market value if you use the business use method described earlier or any other method. If you have used the other method without reducing your basis in the home, your basis is increased by the amount of such excess plus 2,100 (as described in General Allowance Method below).

Generally, the excess of the home's fair market value over the total expenses you claim for business use or the excess over business expenses you can use to figure the credit for the tax year, whether you also claimed a personal use credit on Schedule A.

Use the GAM to figure the amount of your business use deduction, not the amount you can deduct if you are a resident alien.

If you do not use the GAM, reduce the basis of the home by 2,100 and, if necessary, by the reduced amount of the personal use credit. To figure the cost of the home under a business use, use the method that you normally would use to figure the cost of a depreciable basis asset (such as a farm) if you did not use it for business, such as the method for figuring such a basis using the simplified method (described below).

Get the free 2012 form 8829 instructions - taxhow

Show details

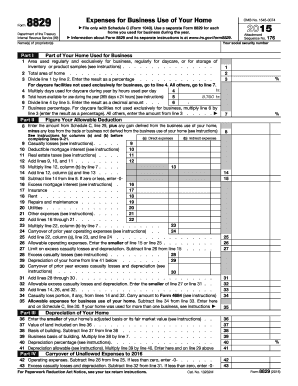

2012 Instructions for Form 8829 Department of the Treasury Internal Revenue Service Expenses for Business Use of Your Home Section references are to the Internal Revenue Code unless otherwise noted.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 2012 form 8829 instructions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2012 form 8829 instructions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2012 form 8829 instructions online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2012 form 8829 instructions. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 8829 instructions?

Form 8829 instructions provide guidance on how to complete and file Form 8829, which is used to calculate and report the expenses for business use of a home.

Who is required to file form 8829 instructions?

Individuals who operate a business or use part of their home for business purposes and meet certain criteria must file Form 8829 and follow the accompanying instructions.

How to fill out form 8829 instructions?

To fill out Form 8829, you need to gather information on your home office expenses, such as mortgage interest, utilities, and property taxes. Then, follow the instructions provided on the form to calculate and report the eligible expenses.

What is the purpose of form 8829 instructions?

The purpose of Form 8829 instructions is to ensure that taxpayers correctly report and calculate their allowable expenses for business use of a home, in accordance with the tax laws and regulations.

What information must be reported on form 8829 instructions?

Form 8829 requires taxpayers to report various information related to their home office expenses, such as the square footage of the home used for business, actual expenses, and depreciation.

When is the deadline to file form 8829 instructions in 2023?

The exact deadline for filing Form 8829 instructions in 2023 will be determined by the Internal Revenue Service (IRS) and can typically fall around mid-April, considering there are no changes to the standard tax filing deadlines.

What is the penalty for the late filing of form 8829 instructions?

The penalty for late filing of Form 8829 instructions can vary depending on multiple factors, including the amount of tax owed and the length of the delay. It is recommended to refer to the IRS guidance or consult a tax professional for specific penalty details.

How can I manage my 2012 form 8829 instructions directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign 2012 form 8829 instructions and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I send 2012 form 8829 instructions for eSignature?

Once your 2012 form 8829 instructions is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I fill out 2012 form 8829 instructions using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign 2012 form 8829 instructions and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Fill out your 2012 form 8829 instructions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.